- AMD projects second-quarter revenue between $7.1b and $7.7b.

Advanced Micro Devices (AMD), a leading player in the semiconductor industry, recently disclosed the financial implications of newly imposed US export controls on its revenue, particularly with regard to shipments of advanced artificial intelligence (AI) processors to China.

According to AMD’s finance chief, Jean Hu, these restrictions are expected to result in substantial $1.5 billion revenue hit in 2025. The announcement sheds light not only on the challenges faced by AMD amid evolving geopolitical and regulatory landscapes but also on the broader implications for the global semiconductor sector.

In an earnings call, AMD revealed that the latest round of export controls, instituted in April under tightened US government policies, mandates that advanced AI chips destined for China require export licenses.

Optimistic outlook

The regulatory hurdle effectively restricts AMD’s ability to ship key products, such as the MI308 AI processor, to one of its largest markets. The company anticipates that these curbs could incur approximately an 800 million charge related to inventory adjustments and purchase commitments.

Despite this headwind, AMD projects second-quarter revenue between $7.1 billion and $7.7 billion—figures that surpass Wall Street’s expectations and are likely buoyed by accelerated chip purchases ahead of the tariff implementations.

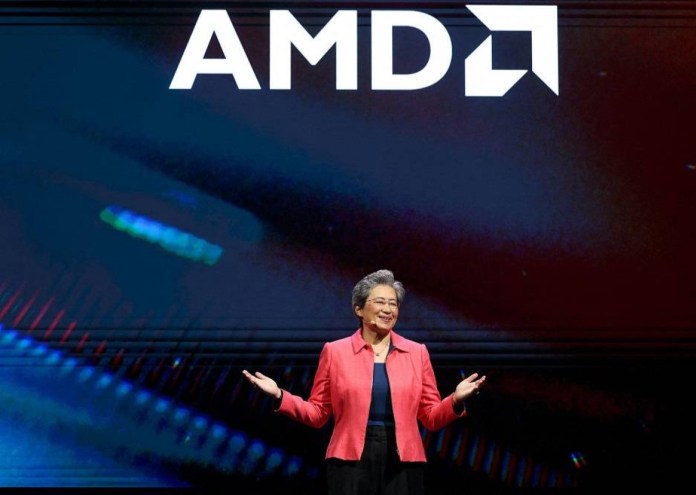

AMD’s chief executive officer, Lisa Su, provided a cautiously optimistic perspective on the situation. She underscored the resilience of the company’s differentiated product portfolio and consistent operational execution, which, despite the “dynamic macro and regulatory environment,” position AMD well for strong growth by 2025.

Su further noted that the majority of the financial impact from the export curbs is expected within the second and third quarters, yet she maintains confidence in the company’s ability to achieve “strong double-digit” growth in AI chip revenue from its data centre business.

Increased volatility

This optimism resonates with AMD’s ongoing commitment to supplying advanced processors to major cloud infrastructure providers such as Microsoft and Meta Platforms, which continue to allocate significant investments toward AI capabilities.

The ramifications of US export controls extend beyond AMD, reflecting a broader strategic effort by the Biden and Trump administrations to limit China’s access to cutting-edge semiconductor technology.

These measures aim to impede China’s development of advanced AI models and applications that the US government views as potential national security risks.

Notably, Nvidia, AMD’s chief competitor, has faced even larger financial repercussions—a $5.5 billion charge—stemming from similar restrictions. Both companies now require export licenses to sell AI chips in China, signaling a profound shift in supply chain and market dynamics.

This heightened regulatory environment has contributed to increased volatility among AI-related stocks, as market participants reassess growth prospects amid fears of overhype and geopolitical uncertainty.

For instance, recent developments such as DeepSeek’s announcement—demonstrating high-performance AI models using less advanced chips—have further pressured chip valuations.

Moreover, the semiconductor industry faces additional trade challenges from tariffs exceeding 145 per cent on products manufactured in China, Vietnam, and Malaysia, with potential further duties looming under the US Commerce Department’s Section 232 investigation.

Discover more from TechChannel News

Subscribe to get the latest posts sent to your email.