- Plans to launch its next-generation MI400 series of AI chips in 2026, targeting both scientific and generative AI applications.

- Data centre is the largest growth opportunity out there, and one that AMD is very, very well positioned for, CEO says.

Advanced Micro Devices (AMD) predicted that its annual revenue from data centre chips would soar to $100 billion within the next five years, fueled by surging demand for artificial intelligence (AI) technologies.

The bold forecast came as the Santa Clara, California−based chipmaker outlined plans to more than triple its earnings, sending shares up by 2.7 per cent to $237.52.

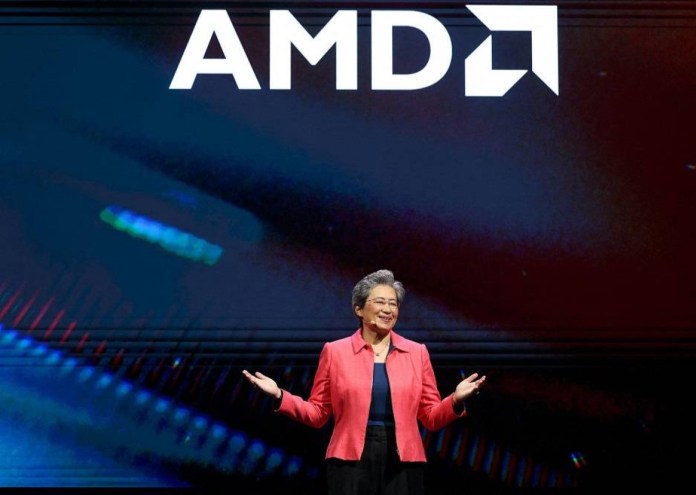

The optimistic outlook was unveiled at AMD’s highly anticipated analyst day in New York—the company’s first such event in three years. CEO Lisa Su told investors the total addressable market for AMD’s data centre products, which include standard processors, networking chips, and specialised AI hardware, is expected to grow to $1 trillion by 2030.

“It’s an exciting market,” Su said. “There’s no question, data centre is the largest growth opportunity out there, and one that AMD is very, very well positioned for.”

OpenAI deal

AMD executives forecast annual business-wide growth of 35 per cent over the next three to five years, with the data centre segment expected to grow at a robust 60 per cent annually, according to Chief Financial Officer Jean Hu.

The upbeat projections come on the heels of a recent multiyear partnership with OpenAI, announced in October, which is expected to generate tens of billions in annual revenue and has driven a 16 per cent rally in AMD’s stock since the deal was released.

While the deal is not expected to immediately challenge Nvidia’s dominance in the AI chip market, analysts say the agreement and AMD’s financial projections should bolster investor confidence in AMD’s ability to capture market share.

Acquisitions

Looking ahead, AMD plans to launch its next-generation MI400 series of AI chips in 2026, targeting both scientific and generative AI applications. The suite will also feature a comprehensive server rack solution to rival Nvidia’s GB200 NVL72 system.

Beyond hardware, AMD continues to invest heavily in software and system integration, recently acquiring server builder ZT Systems and a series of AI-focused software startups, including the latest acquisition of MK1.

“We’ll continue to do AI software tuck-ins,” said Chief Strategy Officer Mat Hein, emphasising the company’s commitment to expanding its technological capabilities and talent pool.

The company also delivered a fourth-quarter revenue forecast that exceeded Wall Street expectations, buoyed by relentless demand for AI chips and strong AI-driven growth in its data centre CPU business.

Nvidia CEO Jensen Huang has likewise projected rapid industry growth, forecasting the broader AI infrastructure market to reach between $3 trillion and $4 trillion by 2030.

Discover more from TechChannel News

Subscribe to get the latest posts sent to your email.