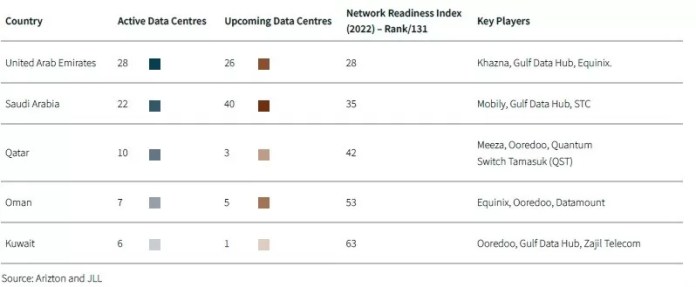

- Currently, UAE has 28 facilities and Saudi has 22.

- With approximately 17 facilities, Dubai is a prime market for data centres, followed by Abu Dhabi in the UAE.

- Key data centre providers in the UAE include Khazna and Equinix apart from hyperscalers and Mobily and STC in Saudi Arabia.

The UAE and Saudi Arabia have the highest share of data centres in the Middle East and Africa with 28 and 22 colocation facilities respectively, fuelled by digital transformation strategies and smart city initiatives.

Key data centre providers in the UAE include Khazna and Equinix apart from hyperscalers and Mobily and STC in Saudi Arabia.

However, according to Arizton’s research data, the future supply pipeline in Saudi Arabia is remarkably outpacing the rest of the countries, with around 40 data centres under development while the UAE is expected to have 26 more.

At a time when data has come to define the parameters of innovation, efficiency and competitiveness, not only in real estate but across industries, Faraz Ahmed, Associate, Research at JLL MENA, said that the UAE is boldly leading the charge in the data centre domain in the region.

A visionary approach

“Through strategic investments in smart city infrastructure, a robust AI strategy, and a visionary approach to talent development, the country is not only becoming an investment hub; it is positioning itself for even greater success ahead,” he said.

According to Arizton and JLL, Quantum Switch Tamasuk (QST) has set a goal to develop six new facilities across the kingdom with a power capacity that would reach around 300 megawatts (MW) by 2026.

This expansion of data centre capacity is on the back of Vision 2030 and the government’s push to make the country the main Information and Communication Technology (ICT) and data centre hub in the region.

To support its goal, Saudi Arabia has launched an $18 billion strategy to partner with local and international investors and establish a nationwide network of large-scale data centres.

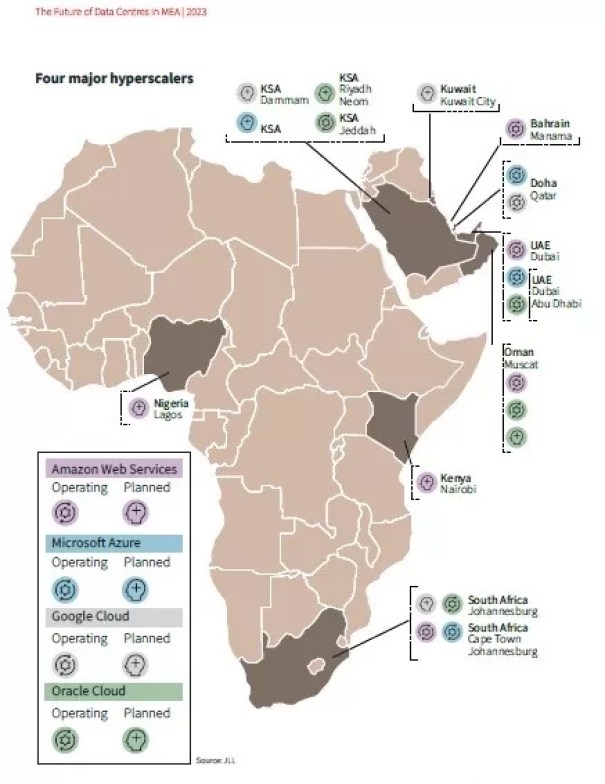

Traditionally, data centre investments in the kingdom have been mainly directed towards the capital city, Riyadh, followed by Jeddah and Dammam.

However, the areas of interest have been expanding and more investments are projected to be pumped into Saudi Arabia’s new smart city, Neom, in the coming years.

This is further supported by the city’s $500 million hyperscale data centre, launched earlier in 2022, which aims to offer fast and reliable data centre services and connectivity to the country and the wider Gulf Cooperation Council (GCC) market.

Khazna to add 12 more

Meanwhile, the UAE has around 26 new data centres that are being developed, which, once operational, will bring the total inventory to 54 data centres.

Dubai is currently the prime market for data centres in the UAE, with around 17 facilities, followed by Abu Dhabi.

Khazna, the leading data centre provider in the UAE, currently operates around 12 data centres across the country and aims to add another 12 over the course of two years, expecting to add a total planned capacity of 300 Megawatts.

Elsewhere in the Middle East, Zenah Al Saraeji, Senior Analyst, Research at JLL MENA, said that other GCC countries are making efforts to attract investments and expand their data centre capacity.

Qatar, for instance, currently has 10 live colocation data centres, with an additional three developments under construction. Furthermore, in May 2023, Google Cloud announced the opening of its Doha cloud region in response to the growing demand for cloud services in Qatar and the Middle East.

Similarly, with six active data centres, Kuwait partnered with Google Cloud earlier this year to open a new cloud region in an effort to support the country’s 2035 vision and achieve its digital transformation strategy. Under the agreement, three sites would be dedicated to opening and operating three mega-space data centres in the country.

5G fuels growth

Moreover, Oman, which has five existing and seven developing data centres, is also considered one of the major regional digital hubs and is focusing on increasing investments in data centres by enhancing its digital infrastructure with 5G networks.

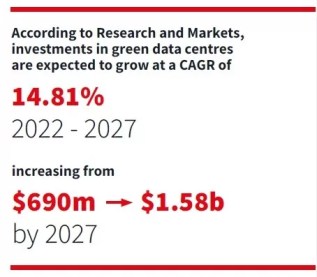

According to a recent report by Research and Markets, the data centre investment market in the Middle East was valued at $4.86 billion in 2022 and is expected to grow at a CAGR of 8.53% from 2023-2028, reaching to $7.94 billion.

“The UAE and Saudi Arabia are expected to be the leading contributors to the growth of data centres, followed by countries like Oman, Kuwait, Bahrain, and Qatar, owing to the rapid deployment of 5G networks,” Al Saraeji said.

Discover more from TechChannel News

Subscribe to get the latest posts sent to your email.