- Desktop AI tools might capture headlines, but mobile apps capture multiple billion-dollar revenues.

- Success of ChatGPT’s mobile strategy has proven that artificial intelligence isn’t just a technology trend, it’s a fundamental shift in how humans interact with computers.

In November 2022, OpenAI quietly released ChatGPT to the world. Within five days, it had amassed one million users; this feat took Netflix three and a half years to achieve. But the real story wasn’t just about user adoption; it was about what would happen when this AI phenomenon went mobile.

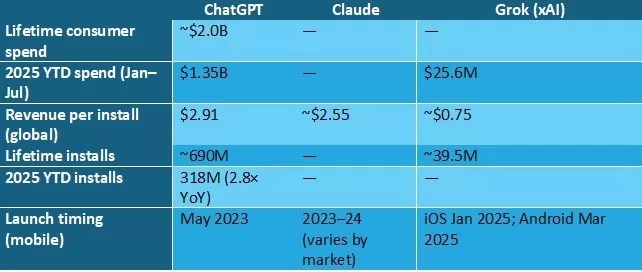

Fast-forward to August 2025, and ChatGPT has achieved something many doubted: $2 billion in consumer spending since its mobile launch. Mobile users are paying for the premium version of the app. To put this in perspective, that’s more revenue than many established tech companies generate annually.

The chatbot now sits comfortably at the number one position on Apple’s App Store, a digital throne that has attracted both admirers and enemies.

Among those enemies is Elon Musk, whose own AI venture, Grok, languishes at #5 on the App Store despite his massive social media following. This disparity has sparked what might be the most high-profile tech feud of 2025 and it may reshape how we think about AI app distribution.

The mobile AI revolution unfolds

This isn’t just about ChatGPT’s success; it’s about a fundamental shift in how consumers interact with artificial intelligence. Where desktop computing once ruled, mobile has become the primary battleground for AI supremacy.

Users aren’t just downloading these apps: they’re paying for them, subscribing to premium tiers, and integrating AI assistants into their daily routines in ways that seemed impossible just two years ago.

ChatGPT dominates with its $2 billion war chest, built on a foundation of first-mover advantage and a premium subscription model that users embrace. Its success story reads like the blueprint in mobile monetisation in the short history of AI chatbots.

Claude, Anthropic’s offering, has carved out a respectable $100-200 million revenue stream by focusing on enterprise customers and emphasising AI safety – a positioning that resonates with corporate buyers wary of AI risks.

Grok, Musk’s controversial creation, only generates an estimated $50-100 million despite its integration with X (formerly Twitter) and its willingness to engage with topics other AI systems avoid.

Microsoft Copilot and Google Gemini struggle with the mobile-first reality, their revenues bundled into larger enterprise offerings or lost in the complexity of search integration.

It is worth pointing out again, that this only refers to the mobile app monetisation, these companies are monetising via web as well for specific enterprise API based solution. OpenAI’s revenues are reportedly about $12 billion per year.

When titans clash

The drama began unfolding in August 2025, when Elon Musk took to his platform X with a series of explosive accusations. Apple, he claimed, was “behaving in a manner that makes it impossible for any AI company besides OpenAI to reach #1 in the App Store.” He called it an “unequivocal antitrust violation” and threatened legal action against the world’s most valuable company.

Musk’s timing seemed curious. His complaints emerged just as OpenAI was crowned as the dominant force in Mobile AI chatbots, dwarfing Grok revenues. And at the same time Apple faced mounting regulatory pressure: a €500 million EU fine for App Store restrictions here, a US Department of Justice antitrust lawsuit there.

Talking about another antitrust violation must hurt a bit at Cupertino. Was this a legitimate grievance or opportunistic pile-on?

The evidence suggests the latter. Let’s point at some facts challenging Musk’s claims: the Chinese AI app DeepSeek had reached #1 in January 2025 in the same category, while Perplexity topped India’s App Store in July, with both achievements occurring after Apple’s OpenAI partnership began in June 2024.

Apple’s response was swift and uncompromising. A company spokesperson stated that “the App Store is designed to be fair and free of bias” and features “thousands of apps through charts, algorithmic recommendations, and curated lists selected by experts using objective criteria.”

But it was Sam Altman’s counterattack that truly escalated the conflict. The OpenAI CEO didn’t just defend his company, he went on the offensive. “This is a remarkable claim given what I have heard alleged that Elon does to manipulate X to benefit himself and his own companies and harm his competitors,” Altman fired back, referencing reports that Musk had created special systems to prioritise his own tweets on X.

The feud, industry observers noted, seemed less about antitrust law and more about a personal vendetta dating back to 2018, when Musk left OpenAI’s board following disagreements about the company’s direction.

The ripple effects across mobile ecosystems

While tech billionaires traded barbs on social media, the implications of ChatGPT’s mobile success were reverberating throughout the telecommunications industry. Mobile Network Operators (MNOs), traditionally focused on voice and data services, suddenly found themselves at the centre of an AI revolution they hadn’t anticipated.

AI apps consume significant bandwidth (as they are driving not just text but increasingly audio and video files). They require low-latency processing, creating demand for edge computing services.

They generate massive amounts of data, opening new monetisation opportunities. Payment service providers faced their own transformation. ChatGPT’s success validated subscription-based models for AI services, but it also highlighted the global nature of AI app adoption. Cross-border payments, micro-transactions for AI services, and new fraud patterns emerged as AI apps scaled internationally.

AI is good news for mobile, even the old fashioned (by now) mobile apps are finding themselves energised by mobile chatbots. Potentially SME and Large Enterprise could be next in finding a mobile version of the AI chatbots. MNOs, App Stores and payments providers could consider bundles and specific vertical solutions too.

Road ahead: Lessons from $2b success story

As 2025 progresses, the ChatGPT phenomenon offers crucial lessons for the mobile industry. First, consumers will pay for AI services, but only if they deliver genuine value. ChatGPT’s success wasn’t just about being first to market; it was about creating an experience users found indispensable.

Second, platform relationships matter more than ever. The Musk-Apple controversy, regardless of its merits, highlighted how app store policies can make or break AI companies. Success in the AI mobile era requires not just great technology, but strategic platform partnerships.

Third, the mobile-first approach isn’t optional, it’s essential. Desktop AI tools might capture headlines, but mobile apps capture multiple billion-dollar revenues. The companies that understand this distinction will thrive even more.

Looking forward, the industry faces several inflection points. Things might change considerably by then. Subscription fatigue may force AI companies to find new monetisation models. Platform integration will deepen, and AI might be part of your mobile phone (i.e., its operating software) just like the Apple-OpenAI blueprint. Specialised AI apps might also emerge for specific industries and use cases.

But perhaps most importantly, the success of ChatGPT’s mobile strategy has proven that artificial intelligence isn’t just a technology trend, it’s a fundamental shift in how humans interact with computers. The $2 billion milestone isn’t just OpenAI’s achievement: it’s validation of a new era in mobile computing.

As Musk and Altman continue their public feud, and as Apple navigates regulatory challenges, the real winners may be the millions of users who have discovered that AI assistants in their pockets aren’t just convenient, they’re transformative.

The mobile AI revolution has only just begun, and ChatGPT’s $2 billion success story is merely the opening chapter.

- Dario Betti is CEO of MEF (Mobile Ecosystem Forum) a global trade body established in 2000 and headquartered in the UK with members across the world. As the voice of the mobile ecosystem, it focuses on cross-industry best practices, anti-fraud and monetisation. The Forum, which celebrates its 25th anniversary in 2025, provides its members with global and cross-sector platforms for networking, collaboration and advancing industry solutions.