- Facebook says it will only be able to pay small businesses a portion of sales from a new paid online events feature

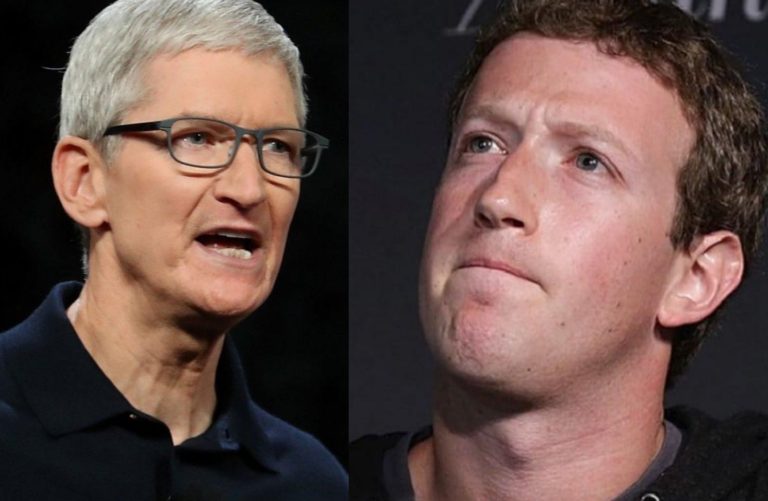

Bengaluru: Facebook said that Apple had declined its request to waive a 30% commission fee the iPhone maker charges apps listed on iOS devices, taking a shot at its fellow Big Tech peer as developers challenge the policy.

“We asked Apple to reduce its 30% App Store tax or allow us to offer Facebook Pay so we could absorb all costs for businesses struggling during Covid-19,” Fidji Simo, the head of the Facebook app, said in a blog post.

“Unfortunately, they dismissed both our requests and SMBs will only be paid 70% of their hard-earned revenue. While Facebook is waiving fees for paid online events we will make other fees clear in the product,” she said.

Paid events

Apple takes a cut of between 15 per cent and 30 per cent for most app subscriptions and payments made inside apps while Google also takes a 30% commission for payments within apps on its Android devices.

Facebook launched the ability for businesses, creators, educators and media publishers to earn money from online events on its platform.

Now Page owners can create an online event, set a price, promote the event, collect payment and host the event, all in one place.

By combining marketing, payment and live video, paid online events meet the end-to-end needs of businesses. Pages can host events on Facebook Live to reach broad audiences, and we’re testing paid events with Messenger Rooms for more personal and interactive gatherings.

“With social distancing mandates still in place, many businesses and creators are bringing their events and services online to connect with existing customers and reach new ones. People are also relying on live video and interactive experiences more when they can’t come together physically,” she said.

In June, Facebook saw live broadcasts from Pages double compared to the same time last year, largely attributed to broadcasts since March.

To support small businesses and creators, Facebook will not collect any fees from paid online events for at least the next year.

“For transactions on the web, and on Android in countries where we have rolled out Facebook Pay, small businesses will keep 100% of the revenue they generate from paid online events,” she said.

Epic Games files lawsuit

On Thursday, Apple removed popular video game “Fortnite” from its app store for violating its in-app payment guidelines, sparking a backlash online and prompting developer Epic Games to file a federal antitrust lawsuit challenging Apple’s rules.

Apple’s App Store is the only way to install software on iPhones, and in recent weeks, top app makers have started to revolt against its rules and the 30% cut it takes from payments.

“When people are paying $20 for a paid online event and they assume that the $20 is all going to the local business they’re trying to support — when 30% is going to an almost $2 trillion company, that’s relevant information for people to have,” Simo said on a press call.

“We felt this was an important thing to call out.”

The social networking giant had warned investors that its income could be impacted by an upcoming feature in Apple’s iOS 14 that could make it more difficult for the social media company to target ads to its users.